52+ can you deduct mortgage interest on rental property

Web Generally deductible closing costs are those for interest certain mortgage points and deductible real estate taxes. Provided the loan was first drawn down before.

Can You Claim Rental Mortgage Interest As An Itemized Deduction

You can deduct mortgage insurance premiums mortgage interest and real estate taxes that you pay during the year for your.

. Web It is important to note that for the mortgage interest deducted on Schedule A you are only allowed an itemized deduction for your main house and ONE additional. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. We can deduct at least.

Web In addition to mortgage interest you can deduct origination fees and points used to purchase or refinance your rental property interest on unsecured loans. Many other settlement fees and closing costs for. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web Up to 25 cash back mortgage interest payments to financial institutions on loans used to improve rental property. Web You can deduct the costs of certain materials supplies repairs and maintenance that you make to your rental property to keep your property in good. Web Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction.

For example if it cost you 3000 to refinance your 30-year. Web The costs associated with obtaining a mortgage on rental property are amortized spread out over the life of the loan. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web Should that owner have a rental income of 36000 taking a 16000 deduction for the mortgage interest reduces their taxable rental income to 20000a. Web This includes property taxes mortgage interest insurance repairs maintenance utilities and any other expenses related to the rental property. Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction.

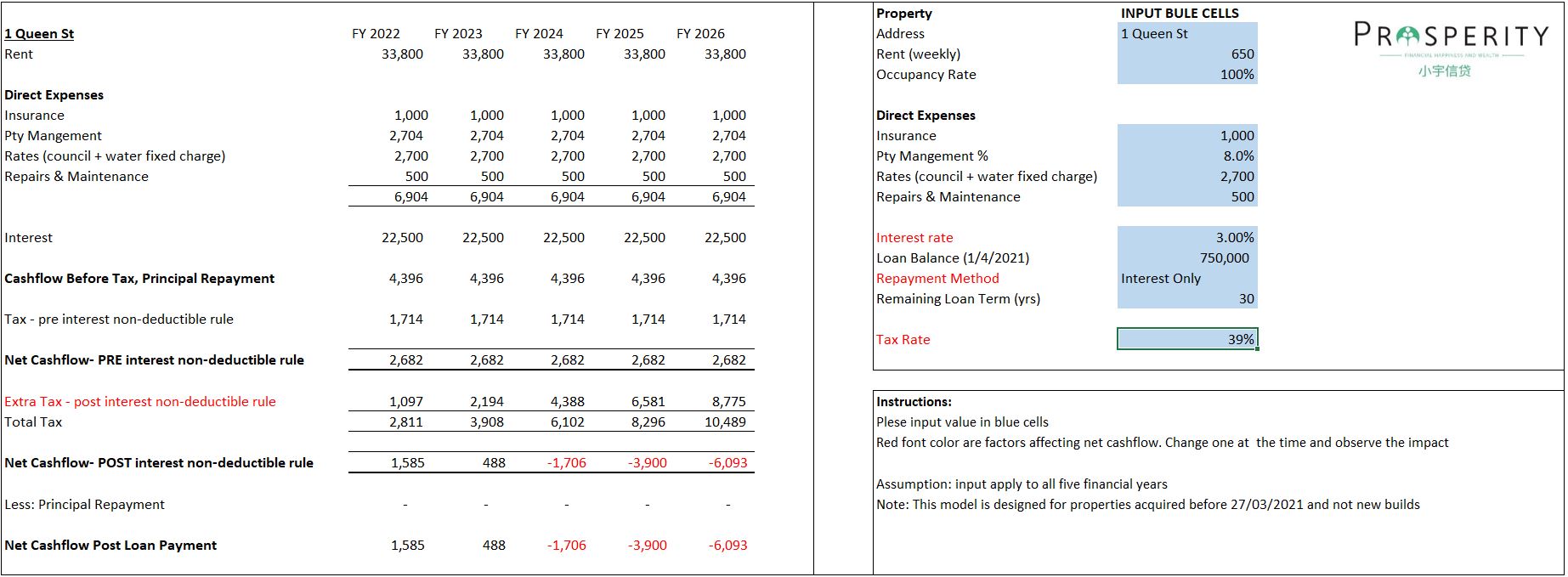

Interest on credit cards for goods or services used in a rental. Web For residential rental property acquired before 27 March 2021 the ability to deduct interest is being phased-out over 4 income years.

Can You Deduct Mortgage Interest On A Rental Property Youtube

New Housing Policy 2021 No Interest Deductions On Residential Rental Property

Can You Deduct Mortgage Interest On A Rental Property

Difference Between Mortgage Interest Deductible For A Rental Owner Occupied

Can You Claim Rental Mortgage Interest As An Itemized Deduction Budgeting Money The Nest

Mortgage Interest Deduction Faqs Jeremy Kisner

Can You Claim Rental Mortgage Interest As An Itemized Deduction

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Mortgage Interest Deduction Faqs Jeremy Kisner

Calameo Ombc Case Water Evidence

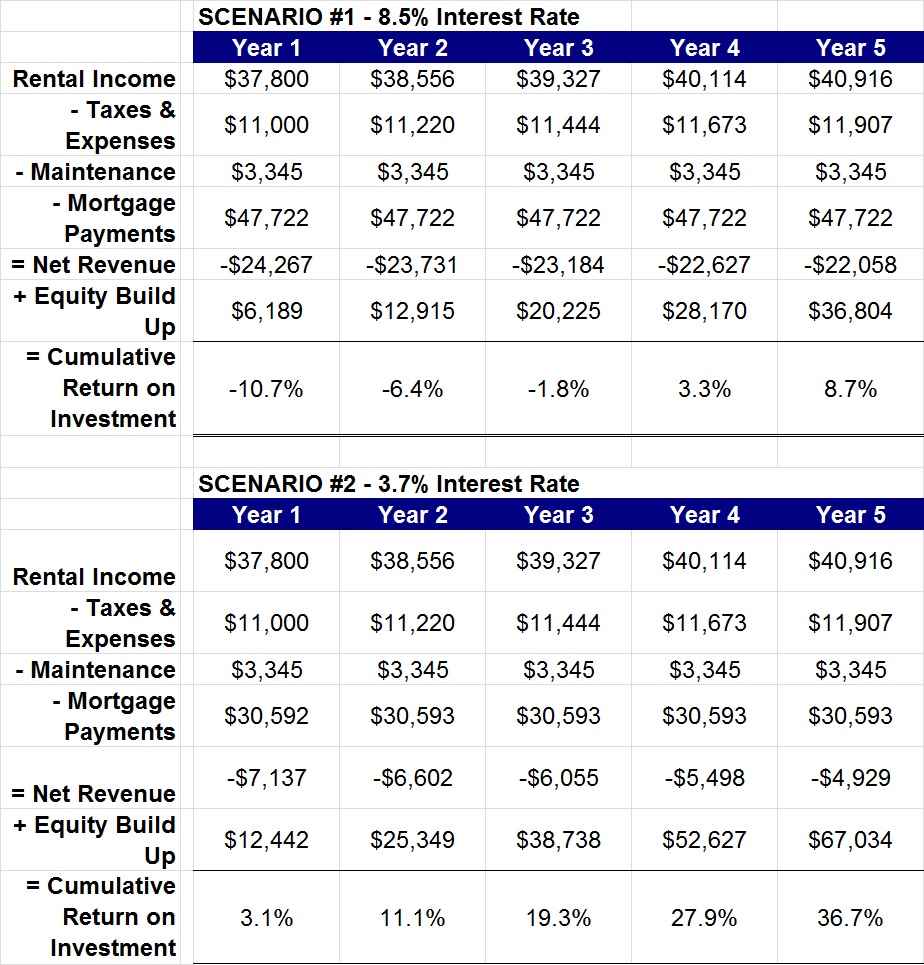

The Hidden Value In Rental Properties When Rates Are Low Dave The Mortgage Broker

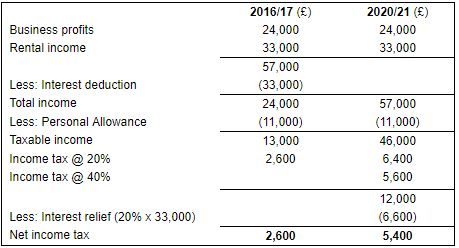

Mortgage Interest Relief Restriction Mercer Hole

Business Succession Planning And Exit Strategies For The Closely Held

Rocky Point Times August 2021 By Rocky Point Services Issuu

Can You Deduct The Difference From Rent To Mortgage Payments For A Rental Property

Interest On Buy To Let Mortgages Eoacc Uk

Everybody Should Buy More Rental Property

Komentar

Posting Komentar